Navy Federal Credit Commitment also offers signature loans having aggressive costs and you can an effective pros. But not, you can find criteria getting is good Navy Government user and you will certain an easy way to sign up for the mortgage.

Of many otherwise most of the companies featured offer settlement in order to LendEDU. These types of income is actually the way we take care of the free solution to have consumerspensation, and additionally hours away from inside the-depth editorial search, identifies in which & just how organizations show up on our website.

Dependent in 1933, brand new Navy Government Borrowing Relationship try an excellent nonprofit economic company you to definitely brings lending products and attributes to over 8 billion users. Now, it is the premier merchandising borrowing from the bank connection regarding You.S.

Being a good Navy Federal member, you must be associated with often the new Department of Defense, National Guard, Armed forces, Heavens Force, Marine Corps, Navy, otherwise Coast guard.

For those who meet up with the subscription standards and so are searching for capital, good Navy Government Borrowing Connection personal loan may be the proper one for you.

Navy Federal Personal loans Assessment

When you need to consolidate credit card debt, financing property upgrade opportunity, otherwise you prefer currency getting something different, you may think taking out fully a personal loan.

For many who meet the requirements, borrowing partnership signature loans, such as those supplied by Navy Government, is going to be a good option as they often promote lower rates of interest and less costs than many other lenders.

Including, Navy Federal hats rates of interest on their signature loans during the 18% . In comparison, of several on line lenders limit their interest cost at thirty six%.

App Process & Qualifications Conditions

One which just get a personal loan out of Navy Federal, you must registered as a member. Registration is actually accessible to the latest U.S. army, You.S. Agency regarding Cover, veterans, as well as their group.

With regards to whether or not to accept players for a loan, Navy Federal looks at an effective borrower’s credit history, its personal debt-to-income proportion, as well as their visit this page current a career status. Yet not, he’s both willing to give so you’re able to individuals with little-to-zero credit score.

It isn’t difficult and you will timely to apply for that loan online. Navy Government has branches available in of many claims, no matter if perhaps not every where.

Navy Government Borrowing Partnership offers various financing terminology from the aggressive costs along with lower charges. Let me reveal some elementary details about taking out fully a consumer loan as a consequence of Navy Federal:

- Rates: Navy Government also provides personal loans which have annual percentage cost out-of 8.19% in order to 18% .

- Terms: Loan fees words was around 180 days

- Fees: There are not any prepayment or origination fees.

- Limits: There are no lowest certificates so you’re able to taking out an unsecured loan from Navy Government. Although not, consumers need certainly to registration criteria.

Positives & Disadvantages away from Navy Federal Personal loans

- Users that either from energetic obligations otherwise try resigned armed forces professionals will get a beneficial 0.25% Apr dismiss.

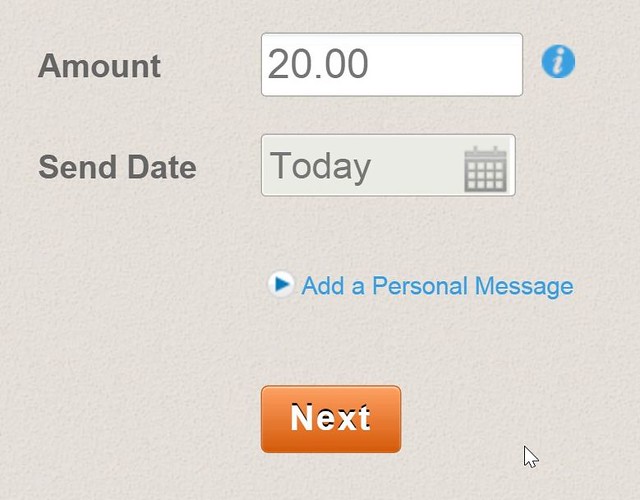

- Navy Government also offers beneficial products to really make it easier for professionals to repay its fund. Such as, it has got a payment per month calculator thus players know very well what their money look.

- Even if you manage to find a lower life expectancy rates somewhere else, Navy Federal caps the limit Apr during the 18%, that’s dramatically reduced than quite a few of their competitors.

- As opposed to most other lenders, Navy Federal can do a hard borrowing from the bank pull-on all of the financing software, so your credit score you can expect to briefly go-down as a result out-of applying.

- You simply cannot pull out an unsecured loan as a result of Navy Government unless you’ve got ties toward U.S. military or the You.S. Service of Coverage.

- You can select a diminished rates along with other lenders. Navy Government is a good option for borrowers that have mediocre borrowing and connections with the army – but consumers having high borrowing from the bank could probably get a hold of an excellent best deal somewhere else.

Options so you’re able to Navy Federal Personal loans

If you are not an army associate otherwise want to consider other choices, look at the loan providers below. Remember, even when, Navy Government professionals is able to secure exclusive experts and you may deals you to definitely almost every other loan providers can not matches. To compare LendEDU’s best picks, you can read our guide to an informed personal loans.