Our Few days Lender Report mortgage may be the service on self-employed which find it difficult to be eligible for home financing due in order to insufficient antique papers. I make use of financial comments to verify money, maybe not tax returns, making it simpler for you to get the home you deserve.

- Loan amount doing $cuatro billion

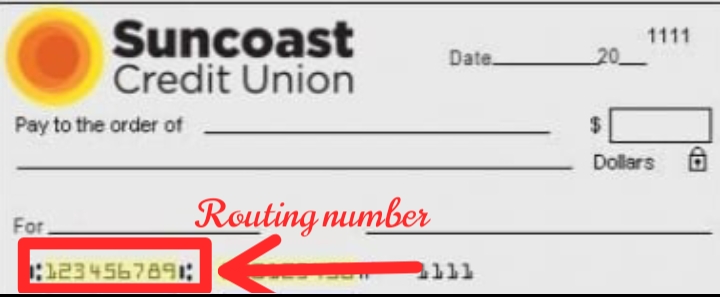

- Financial comments used to be sure income

- Only 90 days out-of reserves needed

- Cash-aside offered

- Present financing acceptance

- Shared comments accepted

- Zero taxation statements necessary

- Quickest change minutes in the business

Few days Lender Declaration FAQ

To have degree purposes, the financial institution spends the fresh deposits made into the company owner’s membership once the income source having qualification objectives, as opposed to having fun with tax returns.

An important difference in a financial Statement loan and you can a traditional financing program is founded on how earnings are confirmed. Financial Report money use your financial statements to ensure earnings, when you’re antique financing play with tax statements and shell out stubs.

In case the normal team earnings is placed towards a personal account, you need private lender statements. Remember, that the might complicate the brand new approval techniques for folks who express which account that have someone, including a partner who has got work. When you find yourself a great 1099 salary earner and you can deposit your income with the an individual account, i encourage having fun with the 1099 earnings program.

Yes. If you be eligible for a lender Declaration mortgage, you happen to be questioned to incorporate a letter out-of an authorized tax preparer. For a lender Statement financing, we do not review tax statements, so we rely on third parties, for example a licensed income tax elite, to confirm specific aspects of your online business.

- Confirmation of the organization’s bills proportion (%)

Zero. Brand new page is going to be regarding one authorized taxation preparer, accountant, or CPA. The brand new page must be to their letterhead, finalized and quick loan Garden City old. We must manage to verify the Preparer’s Tax Identification Count (PTIN) or CPA permit number.

Yes. Brand new page provided is founded on 3rd-group recommendations provided with an authorized taxation elite group that will be maybe not expected to directly satisfy the information about the new taxation statements. Instead of a vintage financial system, when you look at the a financial Report loan program, the lender cannot eliminate a taxation transcript of the applicant’s personal otherwise team returns throughout the Internal revenue service.

You can, but it will be easier to fool around with our 1099 money system. Financial Declaration financing are designed for real advertisers. Thus a different contractor generating 1099 wages is not theoretically care about-functioning. In the event your manager pays the applicant in 1099 wages, then just day this new applicant is recognized as notice-employed is by the Internal revenue service when they file taxation statements, and you may none of these two programs fool around with taxation statements. When the candidates receive 1099 wages, an effective 1099 earnings system was created far more for that form of income and will become providing them with more income and also alot more to order stamina than simply they might with a lender Declaration financing. Both programs was surprisingly comparable in terms of lowest off commission, minimal fico scores, etc.

Sure, you might nevertheless be eligible for a lender Report mortgage for people who very own fifty% regarding a corporate. Although not, if the company mate does not be eligible for an equivalent domestic financing, their qualifying money could be shorter of the its fee. As an example, for individuals who very own fifty% of one’s providers, you might just use 50% of money about financial report earnings studies to own degree intentions.

Yes, it does. We will calculate the organization customer’s earnings using financial statements, and the partner’s money is determined and their W2s, spend stubs, and you may a position verification from their boss.

Zero. An enthusiastic Irs Mode 4506-C authorizes me to receive a good transcript of your own tax statements, and you can signing a person is not needed to have a bank Statement mortgage.

Zero. Co-signers and individuals who do maybe not invade the fresh new household try not allowed to the a financial Statement mortgage program.

Sure, as long as the fresh new bankruptcy proceeding, foreclosure, otherwise quick business was done at least one year ago otherwise expanded. With respect to the period of time after the certificate from name day, it might change the lowest advance payment towards the a property.

Program consult

Zero. Cryptocurrency deposits can not be always qualify for a bank Report mortgage. Just You bank accounts may be used on the money computation.