Deciding on the best Virtual assistant financial is incredibly extremely important. Not merely can it perception your own Virtual assistant financial feel but additionally, it influences their costs.

How to locate an educated Va home loan company

That is the best Virtual assistant financial financial? There isn’t any obvious-slash answer to this package. All loan providers promote various other rates, costs, and you can degrees of provider, and their qualifying standards may differ, also. For the best one for your novel condition, you will have to:

#1. Plan the mortgage application

Before you could initiate trying to get Va fund, you will want to lay this new stage very first. This means rescuing up for the downpayment (or no), having your borrowing from the bank and you will budget in check, and you may avoiding large financial changes in the fresh months before you apply to own sites for loan in Newville Alabama a home loan (operate, money, the brand new credit cards, etc.).

Its also wise to initiate collecting right up all of the documentation needed for your loan. This may involve their Certification off Eligibility (COE), your own bank statements, and your tax returns.

#dos. Put your finances

Your following step would be to creating your financial budget. Before you can start the loan process, you should have a good idea off what you are able spend monthly in your mortgage repayment. Keep in mind their home loan will also include things like people insurance coverage, possessions taxation, and you will HOA fees, if necessary.

You are able to our very own Virtual assistant finance calculator locate a concept of everything you could probably comfortably expend on a property.

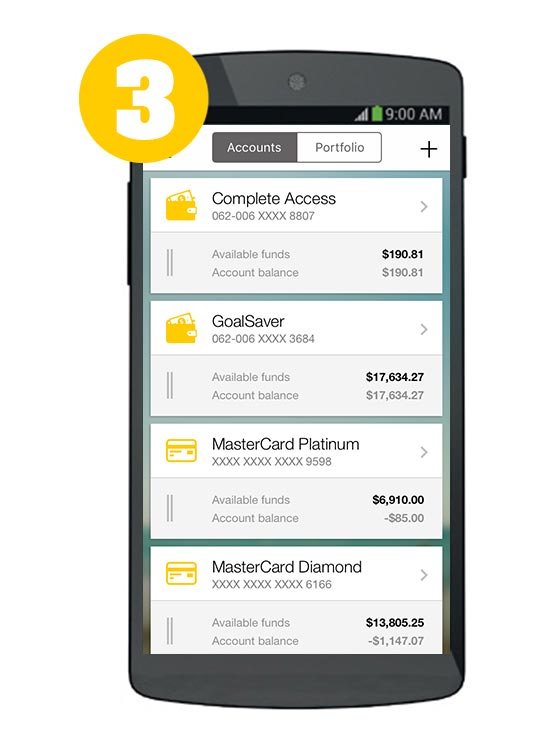

#step 3. Analyze the mortgage options

You understand you prefer good Va mortgage, but there are several kinds of Va mortgages to determine off. Its beneficial to know very well what type of mortgage you need prior to you begin hunting.

Such, if you are a native American veteran and generally are purchasing towards the specific federal places, you’d utilize the VA’s NADL program. If you find yourself refinancing, you could go for a good Virtual assistant cash-aside refinance otherwise Va Streamline Re-finance (plus sometimes known due to the fact mortgage Reduction Refinance mortgage (IRRRL)).

Choosing and that Va home loan program we want to fool around with can assist restrict your selection of Va lenders just like the only a few companies offer the complete suite out-of Virtual assistant finance.

#4pare costs and you will terms from at the least step three-5 loan providers

2nd, it’s time to rating quotes regarding at the least around three Va household mortgage lenders. This involves bringing a little very first suggestions – your revenue, credit history, and other info – even so they always just take just a couple of days to receive.

Once you have estimates off for every single lender, evaluate them range by-line. How can brand new settlement costs and you may charges measure? Think about the pace? Its also wise to factor in the amount of solution and you may responsiveness you received up to now.

#5. Get pre-approved

When you’ve chose the best Va home loan financial to you, it’s time to get pre-acknowledged to suit your mortgage. This basically setting the financial institution has actually analyzed your financial facts and you can thinks you will be a applicant for a loan.

To truly get your pre-acceptance, you’ll be able to fill in a primary app toward financial. After they will have gone over they, you’ll receive good pre-approval page stating how much you might use as well as exactly what interest rate. Possible become so it in almost any provides you with make to demonstrate you are dedicated to your house.

#six. Take a look at the conditions and terms

Finally, make sure to know the loan’s terms and conditions. You will have a beneficial learn to your all of your loan’s terms and conditions prior to signing, including:

- What’s your own closing time?

- Do their rates lock increase through the expected closure big date?

- The amount of money do you want to bring to closing?