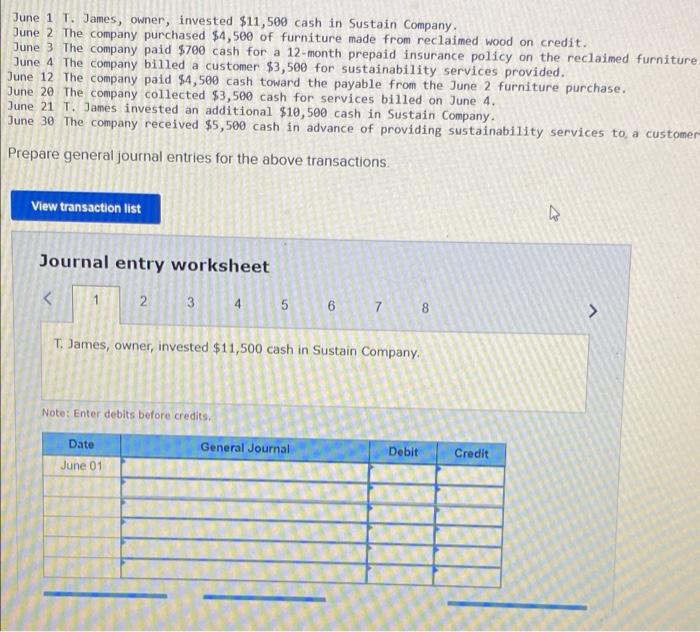

Credit card debt shall be several of the most expensive personal debt you have, and you may save a lot of money by paying all of them away from.

You really need to think twice on the to purchase a new vehicles once your car loan is repaid. Extremely trucks while on the move today last a decade otherwise way more, plus the expanded your drive the auto loan-100 % free, the more money it will save you.

Enhance your advance payment

Extremely traditional loan providers want to see a deposit regarding on least step three%, however, a high deposit make being qualified having a home financing smoother.

That have increased down payment, you might consult a lower loan amount, which may see less risky to help you a lender. If you can establish a beneficial 20% advance payment, you can stop spending private home loan insurance (PMI).

The best way to cut to have a home advance payment will be to put aside money with each salary into the a high-yield checking account seriously interested in their downpayment. When you get some extra money, maybe out-of a bonus in the office or a taxation refund, put those funds into account, as well. You may be surprised how quickly it will sound right.

Choose an area hustle

Taking on a side concert can result in increased month-to-month money, which undoubtedly influences your debt-to-earnings ratio. It can also help it can save you getting more substantial down-payment otherwise repay more of the debt before applying.

Re-finance their figuratively speaking

Refinancing the student education loans is also of use if you have enhanced your credit rating, paid off loans, or improved your earnings because you to begin with lent.

You are capable qualify for another type of loan at a much better rate, that will produce a reduced monthly payment and you can increased debt-to-income ratio.

Refinancing individual student loans is often a viable alternative, but refinancing government college loans form losing government borrower experts, like money-motivated payment and you can Public-service Financing Forgiveness.

And, for many who refinance to increase your own repayment schedule, your financing may cost your way more finally on account of notice accumulation.

Rating preapproved before applying

Of a lot mortgage lenders enables you to determine whether you could potentially meet the requirements for a loan and determine possible mortgage terminology before applying getting a home loan through preapproval. This can be smart so you can find a loan provider possible meet the requirements with and you will bypass tough borrowing from the bank checks that will damage the get.

In addition to, providing preapproved before putting an offer in towards the a property is a good idea because this will usually produce house providers so you’re able to bring your promote so much more positively.

Down-payment guidance may be offered using bodies organizations, neighborhood teams, or nonprofits. Help is more likely getting basic-time homebuyers and you will lower-income customers.

Government-secured lenders may also allow for reduce money otherwise higher DTI ratios than old-fashioned mortgages. These are typically Va finance, FHA fund official website, and you may USDA loans.

Conforming mortgages want a deposit out of 20% rather than demanding the extra price of Private Financial Insurance policies (PMI). When you have a diminished down-payment, PMI becomes necessary. Specific loan providers could go only a deposit away from 3% and you will a before-end DTI zero higher than thirty six%.

FHA fund provides a somewhat large advance payment dependence on step three.5%, even so they accommodate an effective DTI of up to 43%. Virtual assistant and you can USDA money allow good 0% advance payment to own qualifying consumers and you will a great DTI as much as 41%.

Consider an inferior home

To acquire less than you really can afford-instead of overextending you to ultimately buy a pricey household-may help establish you to have economic success with techniques. But most of all the, it will reduce the total cost of the financial, possessions taxation, and you may maintenance will set you back.