- HUD against. this new FHA: What you need to Understand

- What’s HUD?

- What’s the FHA?

- Related Concerns

- Score Financing

What is the difference in HUD plus the FHA?

HUD and FHA, otherwise Federal Homes Administration, was basically dependent on their own, however, display several things. HUD oversees domestic and you can multifamily insurance coverage software, since FHA generally deals with domestic lending to own primary homes. The latest FHA was made from the Government Casing Act out of 1934 americash loans Somerville to help you remind owning a home and increase the production out-of houses in the united states. Adopting the housing drama of 2007-2010, the new FHA turned into one of the biggest insurance vendors off home financing from the You.S. HUD sooner or later contains the insurance to have FHA multifamily financing apps such as for example the HUD 221(d)(4) to own multifamily structure and good-sized rehab, the fresh new HUD 223(f) system to own multifamily acquisitions and refinancing, while the HUD 232 and you can HUD (f) software towards the build, generous treatment, purchase and you may refinancing off older life and healthcare characteristics. For more information on HUD multifamily loans, just fill in the design lower than and a great HUD credit pro will get in contact.

What forms of finance really does HUD bring?

HUD also provides several kinds of multifamily resource, like the HUD 223(f) loan and the HUD 221(d)(4) system. This new HUD 223(f) loan offers financing-to-really worth (LTV) ratios as much as 85% and you will debt service exposure ratios (DSCRs) as little as step 1.18x to have field-price qualities, having high LTVs minimizing DSCRs to have affordable features. The new HUD 221(d)(4) program is actually for flat design and you can ample rehabilitation, however they are going to be even more risky. The HUD Apartment financing was non-recourse, fixed-rate, and you may fully amortizing more than thirty-five+ age.

Which are the great things about HUD fund?

- Less time and cash allocated to brand new recognition and you may origination process

- HUD 232 refinancing from several characteristics can also be greatly improve earnings, probably offering developers the capital to invest in otherwise construct brand new property

- HUD fixed-price money lets highest organizations so you can balance out expenditures and work out specific monetary forecasts really of the future

- Massively good influence

What are the criteria getting HUD money?

HUD finance are created to let borrowers of all sense levels supply the financing they need to succeed in the newest multifamily houses s is merely 620, and there is choices for individuals which have actually down ratings. For each possessions must be covered by possessions and you will liability insurance getting the duration of the borrowed funds. The original year’s superior need to be paid-in complete within closure. Simultaneously, borrowers ought to provide their loan providers which have proof of insurance rates into otherwise up until the closure go out or before policy’s restoration day.

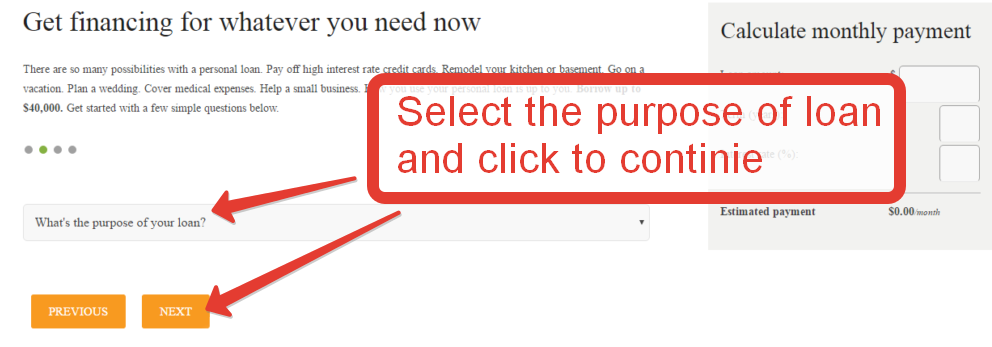

How to get a HUD loan?

Obtaining a beneficial HUD mortgage is actually a two-area procedure. Basic, you’ll need to fill in a loan application towards the HUD, which has getting documentation instance an effective transmittal letter and an App to own Multifamily Property Investment (Function HUD-92013). You’ll also have to pass an intergovernmental review and fill in Byrd Amendment paperwork. On the other hand, you’ll need to disclose one previous legal actions out-of activities involved on the venture. To check out a complete listing of documents you’ll want to submit an application for an enthusiastic FHA/HUD 221(d)(4) financing, check out our very own FHA/HUD 221(d)(4) financing checklist.

In addition to providing acceptance off HUD, you will need to select a keen FHA subscribed bank. It’s important to remember that this new FHA/HUD simply guarantees the mortgage, which will be not in reality guilty of loaning brand new borrower any money. Ergo, it is best to talk about assembling your shed that have multiple FHA signed up loan providers, in order to understand a lot more about techniques together with benefits and you will cons of prospective lenders.

What is the difference in FHA and antique money?

An element of the difference between FHA and conventional funds would be the fact FHA funds is insured because of the Government Construction Government, if you’re conventional finance aren’t. FHA fund are made to let individuals with down income otherwise credit ratings qualify for a home loan. They generally provide reduce costs and you can interest levels than just conventional financing. Antique money, at exactly the same time, commonly insured by authorities and tend to be to have higher loan numbers. However they usually wanted highest fico scores and you may down money than just FHA fund.