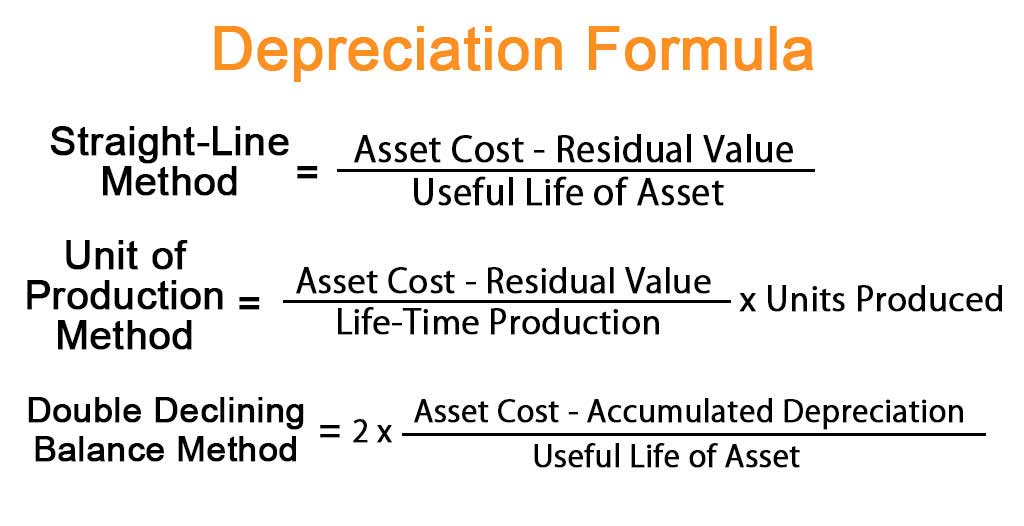

Depreciation is described as the mechanism to calculate the drop in value of an asset through its useful life. When assets are used across their estimated valuable life, they tend to undergo a level of degradation owing to various reasons. Companies purchase physical assets, also known as tangible assets as they add value to their business. Suppose a business purchases an asset costing 9,000 with an estimated salvage value of 1,000 after a useful life of 4 years. This approach requires a larger number of calculations and may be difficult for management to implement. However, the additional work is likely justified by the benefits of using more accurate numbers that provide a better match between Depreciation expense and revenue.

Calculate sum of the years’ digits depreciation

To find the delivery truck’s remaining useful life, we need to count it from the start of each year rather than the end. This may seem strange to you at first, but you will get the hang of it soon with practice. Deskera can also help with your inventory management, customer relationship management, HR, attendance and payroll management software. Deskera can help you generate payroll and payslips in minutes with Deskera People. Your employees can view their payslips, apply for time off, and file their claims and expenses online.

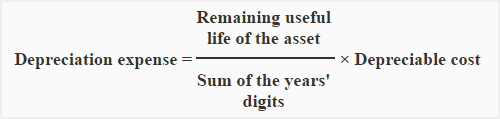

- Sum of the Years’ Digits Method involves finding the sum of all digits between zero and the number of years in the asset’s useful life.

- For example, if the fixed asset has 5 years of useful life, the remaining useful life on the first-year calculation of depreciation is 5 while the last year or fifth year will be 1.

- Create a depreciation schedule to model how these assets can be depreciated.

- As a small business owner, you are well acquainted with the tax deduction for depreciation.

Sum of Years Digits Depreciation Calculator

For Years 3 and 4 of the asset, the remaining useful life will be counted as 2 and 1, respectively. For calculating depreciation for the first accounting period that ends on 31 December 2020 (Year 1), the remaining useful life of the delivery truck will be taken as 4 years. For the next accounting period that ends on 31 December 2021 (Year 2), the remaining useful life will be 3 years. For the Years 3 and 4, the remaining useful life will be 2 and 1 respectively.

How to calculate from beginning book value to depreciation expense

Depreciation expenses are recorded for accounting purposes and its calculation is, therefore, important to a business. This results in a reasonably constant expense related to the asset because depreciation expense declines as repair expense increases. The depreciation schedule using sum-of-the-years’ digits for equipment is shown below. Beth purchased a display shelf for her bakery costing $10,000 on 1 January 2020. The has a useful life of 4 years after which it is expected to have no residual value.

What is the Matching Principle in Accounting? [Explained]

Depreciable cost in sum of years digits depreciation can be calculated with the formula of fixed asset cost deducting its salvage value. The remaining useful life is the only value in the SYD depreciation formula that varies from one accounting period to another. The sum how to track your small business expenses in 7 easy steps of years’ digits is simply an addition of all numbers between zero and the number of years of an asset’s useful life. As an accelerated method of determining depreciation expense, sum of years is most suited for assets that lose their value quickly in the beginning.

Sum of The Year’s Digits Depreciation Model – Formula, Examples, Journal Entries

In the second year, the asset value subject to depreciation would be expensed 4/15 (26.67%). In the third year, the asset value subject to depreciation would be expensed 3/15 (20%). This would continue until the asset was fully depreciated, having been completely expensed on the income statement and fully depreciated on the balance sheet. Because it’s an accelerated depreciation method, the sum of the years’ digit more accurately reflects the true value of assets that use up a higher percentage of their useful value in the earlier years.

Hence, for an asset that has a useful life of 4 years, the un-depreciated useful life to be used in calculating depreciation shall be 4 years in the first year of depreciation, 3 years in the second year and so on. Un-depreciated useful life is equal to the number of years in the asset’s useful life that have not yet been subjected to depreciation. Once a company decides on a depreciation method it typically has to stick with that depreciation method going forward for that particular asset. Changing would require a revision of all previously submitted financial statements.

The primary advantage of this method is that it provides a more accurate trend for Depreciation expenses. That is, the expense tends to be higher in early years, which makes sense if an asset gives up its benefits faster earlier on. Accelerated depreciation is also appropriate for assets that have higher repair expenses in later years. From a conceptual perspective, these methods are most suited for assets that give up a greater portion of their benefits in their early years.