- shares of one’s post

- shares of your post

Having mortgage rates of interest hitting levels perhaps not viewed consistently, homebuyers has to think and work even more smartly than in the past to track down a great deal thereon the-crucial financing, pros state.

Average 30-year fixed mortgage loans recently exceeded 5 per cent, based on Financial Reports Every day, and therefore tracks daily, real-big date changes in lenders’ rates. That’s mortgage not seen given that 2011, save for all days inside 2018. And therefore price try 1.75 payment circumstances more than it had been at the beginning of the entire year.

This has been the quickest and sharpest run-upwards in financial rates in twenty-eight years, says Greg McBride, head financial expert on Bankrate, a financial information website. It is akin to good 17 % boost in home values, merely due to the fact January.

Those people highest costs, spurred because of the rising prices, the fresh Russia-Ukraine conflict, and previous motions by Federal Set aside, might possibly be enough to discourage certain create-be home shoppers-especially when in conjunction with the average thirty-two.step 3 percent rise in home values since the just last year, as outlined by Zillow. However, McBride although some state there is certainly nevertheless numerous urges inside the genuine home age, you need tactics to have the best home loan you can easily.

Tidy up Your Borrowing

Those individuals records are recommendations one gets into your credit score, an loans in Ohatchee option determinant of the speed you will get. Completely wrong, negative guidance could have an effect on your ability to locate a reduced rates.

Go to AnnualCreditReport free-of-charge duplicates off credit history from the nation’s about three major credit rating bureaus, Equifax, Experian and Transunion. You may be permitted that it totally free recommendations one time per year.

Generally speaking, banking institutions wanted people to have a credit score of 740 in order to be eligible for the quintessential aggressive costs, McBride says. View the easy methods to raise your personal.

Choose a fixed- otherwise Changeable-Rates Loan

Should you decide in which to stay your residence for around ten years, a thirty-season fixed-price loan-which have seemingly low monthly premiums-is the best option.

If you can manage large money and wish to distribute having the debt sooner or later, believe a good 15-year repaired. It have a lowered interest and can even save thousands over the lifetime of the borrowed funds.

Another option is to choose a smaller-identity changeable-rates mortgage. These mortgage loans function straight down pricing to have an introductory months, up coming a higher rate. With the a beneficial seven/step one varying, like, the interest rate stays repaired to possess eight ages. Up coming several months, it will adjust according to market prices but may simply boost all in all, 5 payment circumstances above the amazing speed.

If you’re planning to be in your house for decades so you’re able to become, this might not your best option, particularly when interest levels still trend highest. You don’t want to get in a posture in which your adjustable-speed mortgage actually starts to to change and you are susceptible to a huge percentage boost, McBride states.

McBride states these funds become more risky than simply they’re when you look at the during the last as their cost will be different every six months. Up until now, pricing altered one time per year, nevertheless financial marketplace is already changing the brand new monetary directory to your that they is actually located in like of a directory you to definitely change more frequently.

Shop for financing

![]()

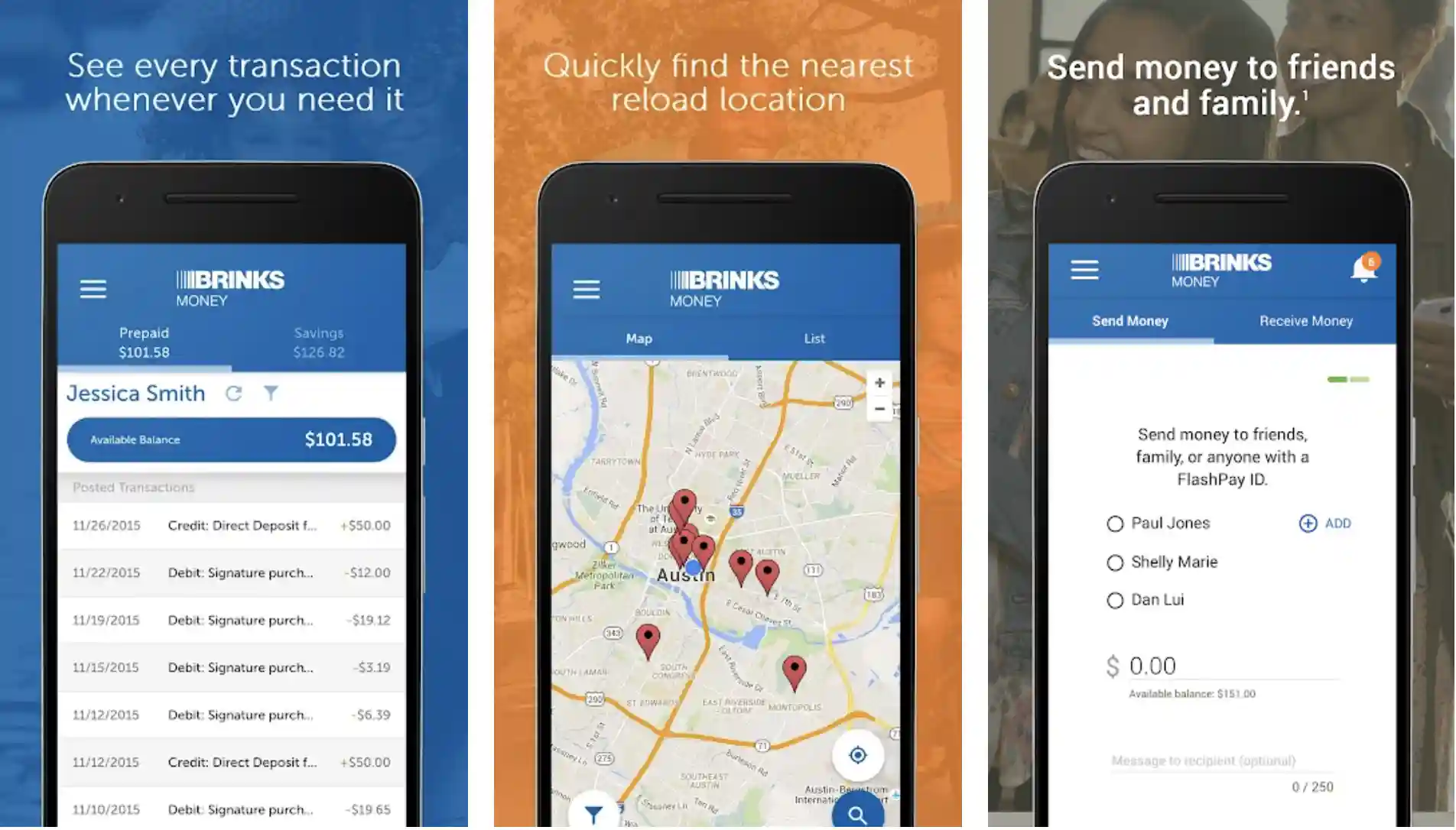

Search for a mortgage from the several loan providers, as well as banks; lenders; on the internet originators, such as for instance Quicken Financing; and you can aggregators, for example LendingTree. Check out its websites and you can fill out first versions to track down rate of interest estimates quickly otherwise calls away from organization representatives who can quickly score prices for you. It’s also possible to go to Bankrate examine mortgage rates and you can find the best selling.