Article on Missouri Mortgage loans

Missouri, the brand new Inform you-Me County, is known for the steeped records, lake towns and you will wider-unlock flatlands. Of these trying to circulate truth be told there, Missouri financial cost try a small more than mediocre. Missouri counties’ conforming financing limitations are practical, with just moderate version during the FHA restrictions.

Federal Home loan Rates

- Missouri possessions taxes

- Missouri old age taxation

- Missouri income tax calculator

- Discover more about home loan rates

- How much house are you willing to afford

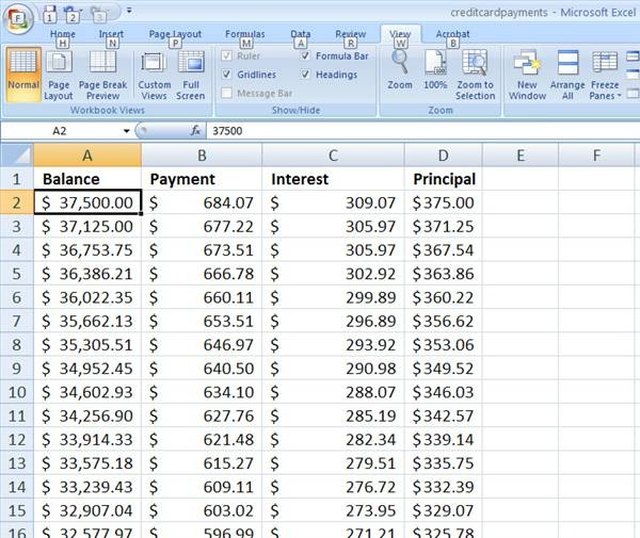

- Assess month-to-month mortgage repayments

- Infographic: Ideal metropolises to get a mortgage

Missouri Mortgages Analysis

Most of the county regarding the condition has an elementary compliant loan limit out of $726,200. All the condition have an elementary FHA restriction out-of $472,030 as well. The compliant and you will FHA financing restrictions inside Missouri are a reflection of one’s standard value of residential property throughout the state.

Missouri was a deed out of believe state. It indicates after you purchase a property from inside the Missouri, the latest file you signal try an action out-of trust unlike a home loan. A portion of the differences having an action out of believe would be the fact it lets lenders who would like to foreclose for the property so you’re able to avoid the fresh judge program when performing thus. Rather the financial institution can initiate an electrical power out of income foreclosures by choosing an authorized to market the home.

Missouri has a house revelation laws and regulations, definition the vendor need certainly to reveal just what problems they know in regards to the property. Of course, which is a positive to have consumers. But it’s constantly far better opt for a property check just before technically closure in your where you can find protect from any unforeseen unexpected situations because property is your own.

30-Year Fixed Mortgage Cost in the Missouri

Extremely homebuyers choose a 30-year fixed-rates financial. So it reliable solution gives people years of your time so you’re able to pay the mortgage. Given that home loan rates remains the exact same during the course of the borrowed funds, the new monthly payments hold constant also.

You can envision good 15-seasons repaired-rate home loan that enables that repay the loan for the a smaller period of time and has a lower interest, but the disadvantage on the would be the fact the monthly premiums tend to become large.

Missouri Jumbo Loan Cost

Missouri home strike right-about average the remainder of the new country, so the old-fashioned loan restriction holds regular on $726,2 hundred in just about any condition. A beneficial jumbo financing try any mortgage that’s higher than that restriction. Conforming loan restrictions can be found because giving a loan past you to price gift suggestions a larger risk having lenders. This is why, jumbo finance incorporate higher rates to help personal loan companies with no origination fee you counterbalance that exposure. However, it’s important to keep in mind that jumbo mortgage rates are down than just fixed pricing.

Missouri Sleeve Loan Pricing

A special home loan option is a variable-rates financial (ARM). An arm was a mortgage one does exactly as the name lets you know it’s got an interest rate you to definitely adjusts or change through the years. An element of the destination off an arm is the fact are also provides an effective straight down 1st interest than the a predetermined-rates mortgage. It low-rate is present for 1, around three, four, 7 otherwise a decade, with respect to the loan’s terms. Immediately after that period has arrived to help you an almost, the interest rate increases otherwise drop-off one time per year, however usually can intend on it increasing.

The new terms of the borrowed funds often spell out how many times the pace can change and the higher peak that it can plunge to help you. Thus you will do know very well what you’re going to get to the for individuals who get a hold of an arm. It’s very crucial that you evaluate what one to interest rate limit are and make sure that it’s the one that you could potentially in reality afford.

Missouri Home loan Information

Purchasing a house for the Missouri? If you need recommendations, here are some of one’s solutions that may help you in the people action of your own procedure.

The fresh Missouri Houses Innovation Payment offers software to aid homebuyers safe their basic home. The newest MHDC Beginning Mortgage Program brings bucks help assist first-day homeowners get a mortgage. The loan Borrowing Certificate system provides very first-time homebuyers who happen to be money eligible which have a way to all the way down the government income tax due a year, freeing right up some money to get returning to the home.

Missouri’s Beyond Casing classification have a great homeownership cardio that gives degree and guidance to arrange customers for homeownership, financing features having advance payment and you may closing cost guidance of these who’re eligible and you can foreclosures input programs to own during the-exposure homeowners.

Readily available Resources

The united states Department out-of Agriculture Outlying Creativity program now offers financing help and you may mortgage features from the whole nation. The applying will come in a lot more rural areas of a state for the purpose of permitting with safe, reasonable housing to possess owners. Missouri has provides and you will funds readily available for house repairs as well given that financing assistance programs just in case you meet the requirements.

Missouri Financial Taxation

There aren’t any import taxes for the a home deals into the Missouri. This means none the customer otherwise supplier would have to spend these taxation in the closing.

Missouri property owners just who itemizes deductions with the government taxes normally twice the borrowed funds interest deduction through the use of it so you’re able to both federal and county income tax filings.

Missouri Financial Refinance

Refinancing will help cut thousands of dollars from your overall mortgage. If you are wishing to re-finance your Missouri home, your house Sensible Re-finance Program (HARP) has stopped being available to choose from. However, Fannie Mae’s Highest Loan-to-Value Refinance Option is a feasible choice.