In that case, your BEP is the average number of trips you must make. If you sell a service and want the BEP expressed in the number of hours you must bill each month to break-even, you need to enter your hourly rate. If you need the BEP expressed in the number of days, enter your daily rate. Remember, the break-even point is the number of units you must sell so that your business has neither a profit nor a loss.

Outsource fixed costs

When more customers are happy with your product and service, the more they will recommend your product to other people. Either way, you should have an effective means to track if your campaigns are generating awareness. You can monitor this by checking analytics for pay-per-click ads. If your campaign has been on for a few months with hardly any improvements to your sales, it’s likely better to cancel them. At the end of the day, it’s a waste to keep paying for ineffective ads. According to Chron Houston Chronicle, five of the largest expenses companies spend on include work space, employer payroll contributions, inventory, advertising, and travel.

Effective Marketing Strategies to Boost Sales

Using a break-even calculation can help assist investors in making those judgment calls in a more informed way. In particular, there are two situations that often come up where knowing a break-even interest rate can help you make better decisions. With the break even result you can start to analyze the micro components that create the overall cost.

Determine profitability

If you’re looking for other small business tips and accounting tools, we’re here to help. QuickBooks can assist with tasks from bookkeeping and payroll to inventory analysis and profitability. Contact us today to discover apps for accountants what QuickBooks can do to help you with all of your small business accounting needs. If you’d prefer to calculate how many units you need to sell before breaking even, you can use the number of units in your calculation.

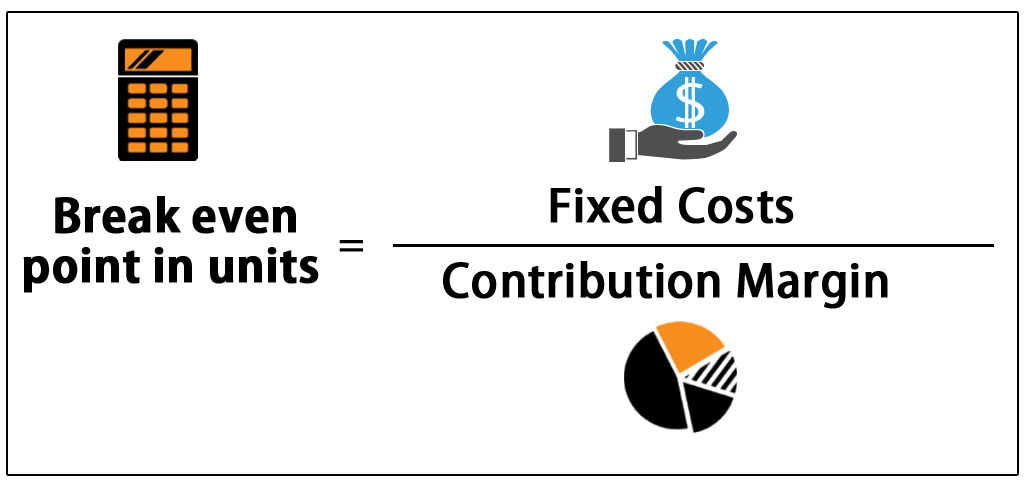

The break-even point (BEP) is the point at which the costs of running your business equals the amount of revenue generated by your business in a specified period of time. In other words, your company is neither making money nor losing it. Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The break-even point (BEP) helps businesses with pricing decisions, sales forecasting, cost management, and growth strategies. A business would not use break-even analysis to measure its repayment of debt or how long that repayment will take. It’s important to study the feasibility of any project or new product line that you’re planning to launch.

- Break-even analysis can also be a great way to measure and benchmark your business’s performance over time.

- This will help you price your products or services at the right level, as well as manage operational expenses efficiently.

- On the other hand, if you’ve been renting commercial space for a while, try to talk to your landlord.

- If you are looking to make and investment or startup your own business, it is important to know your break even point first.

- Please go ahead and use the calculator, we hope it’s fairly straightforward.

When it comes to planning your cash flow and profit approach, you can use BPE as references for different products or services you are offering. By raising your sales price, you’re in turn raising the contribution price of each unit and lowering the number of units needed to break even. With less units to sell, you lower that financial risk and instantly boost your cash flow.

The analysis becomes more complex and less accurate if you offer a wide range of products with different price points and variable costs. For example, If you sell both high-end electronics and low-cost accessories, a single break-even analysis won’t account for the differing profit margins. You’d need individual analyses for each product category to get a more accurate picture of your profitability. The break-even point is calculated by dividing your fixed costs by the difference between the sales price per unit and the variable cost per unit. This tells you the number of units you need to sell to break even. Besides the cost of production, operational expenses are crucial for your business.

The calculations do not infer that the company assumes any fiduciary duties. The calculations provided should not be construed as financial, legal or tax advice. In addition, such information should not be relied upon as the only source of information. This information is supplied from sources we believe to be reliable but we cannot guarantee its accuracy.