When you find yourself possible homebuyers commonly look for homes that are currently created, you will find some that have specific ideas about needed their dream the place to find browse. Those people consumers will most likely believe that have their residence built from the floor right up. And just have a home established allows the long term homeowner to possess control of venue, looks, and all of new great features, the real procedure for getting house and you can design loans doing this new dream is going to be state-of-the-art and you will pricey.

What is an area Mortgage?

Residential property loans, also referred to as package funds, are acclimatized to purchase an area regarding residential property, upon which a property is sometimes centered. The same as a mortgage, possible people may that loan using a lender or other financial institution that have an identical certification process. The fresh land https://clickcashadvance.com/payday-loans-ia/charlotte/ value is even considered. These types of financing have a tendency to wanted a higher down payment and you may interest rate, as well.

How will you Rating a secure Mortgage?

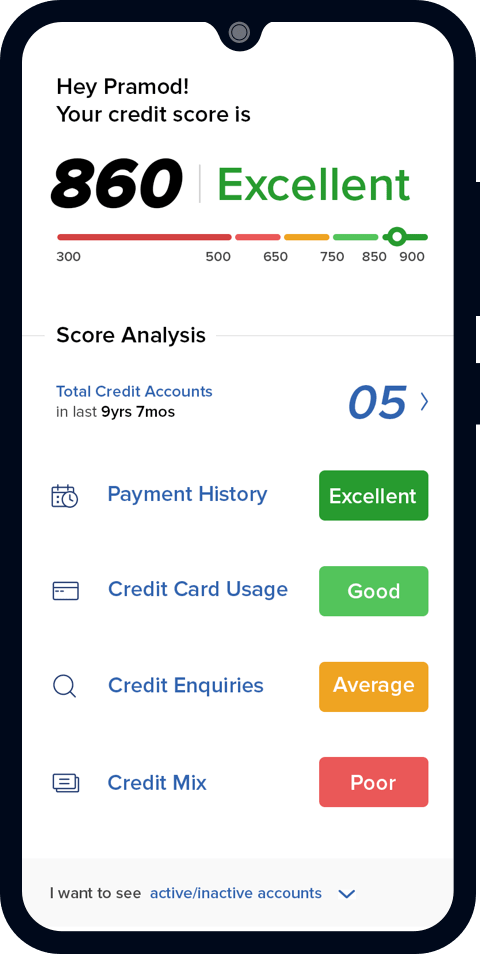

Obtaining a land mortgage is quite like providing a standard mortgage. Regardless if more loan systems provides some other qualifications, you’ll need a very strong credit rating (around 720), plus financial obligation-to-money ratio must not be people higher than 30%.

And the economic criteria having a land loan, additionally need to complete an explanation regarding the meant have fun with of one’s home that takes into consideration the various aspects of building, plus zoning checks, utility accessibility, have fun with restrictions, and you can surveys. This article enable the lending company and also make a comprehensive choice off acceptance, costs, or other terms of the mortgage.

The eye prices to have belongings funds tend to be greater than the ones from basic mortgage loans as they are thought increased chance due brand new belongings try a unique collateral and several loan providers feel that a clear package disincentivizes mortgage non-payments. Furthermore, in place of the brand new age-long payment terms of a mortgage, house finance will simply have several- so you’re able to four-year installment episodes, tend to that have an effective balloon commission in the bottom.

Samples of Land Mortgage Items

Before applying getting a land mortgage, it’s important to dictate precisely which kind of financing product is necessary. Let’s look at the popular sorts of fund that economic associations provide.

Brutal Homes Mortgage

Raw home is completely undeveloped. Consequently there are not any resources (we.e., electricity), sewage options, or roads. If you find yourself intense home now offers a lot of self-reliance, getting financing having brutal residential property is incredibly hard. Prospective individuals should write reveal policy for how they plan to develop the fresh belongings to your financial. They should additionally be happy to shell out a hefty down-payment (essentially up to 20%, however, right up fifty%).

Parcel Home Mortgage

The essential difference between intense house and parcel homes is that the second has many innovation otherwise infrastructure inside. Lot residential property may be zoned to have domestic creativity and might enjoys usage of personal tracks, resources, a good sewage system, and you can survey accounts.

Qualifying to possess a great deal home mortgage (aka enhanced residential property mortgage) will be much simpler than providing a brutal homes loan. Although not, package land fund also can get tricky. Including, in case the plan would be to help make your own home, you could face the chance of having to take out around three loans: one to your package, that to your build, and you will a third mortgage who would combine this new payments on the previous two.

While parcel residential property finance usually feature down rates than simply brutal residential property loans, an identical strict qualification standards and you may tall down payment can be applied. This new terminology within these fund can also be work at for as much as 20 years.

Design Finance

A construction financing was an initial-label, high-desire loan that is used to build assets. In the of several financial institutions, brand new borrower enjoys 1 year to complete the construction and you will a good certificate from occupancy must be provided contained in this that time.