Decreasing the price of college is certainly going a long way in order to so it is more affordable. Pair that with saving having school and you gone a long treatment for decreasing the burden regarding figuratively speaking. The goal is to scholar that have zero loansor perhaps only you’ll.

Opportunity Costs

Whenever we depend purely into mathematics, it can make far more feel to expend, rather than pay extra towards home loan. $500 30 payday loan Hurtsboro days extra on your financial get save you

Assuming home financing equilibrium off $two hundred,000 within cuatro%, having 20 years remaining with the term. Make payment on minimum commission will mean you can spend $90, inside the attract. Incorporating $500 1 month into the fee can save you $37, and can shave off in the eight ages.

The alternative would be to purchase one $500 30 days. If we dedicate $five-hundred 30 days with the the lowest-cost broad-depending index fund you to definitely averages 8% for the next thirteen age (enough time it might simply take me to pay-off the loan using this type of more income) makes united states having $134,. A very old-fashioned get back regarding 6% create exit us that have $117,.

You simply can’t Downplay Freedom & Liberty

As you can tell, the new mathematics leans heavily towards the paying over paying down the mortgage. not, there are more circumstances on gamble. Exposure is the one. Discover no financing exposure whenever repaying the mortgage. Youre protected a good 4% return, within example. You’re not protected anything whenever committing to the stock market, no matter how well-diversified.

Comfort is yet another basis. The security having a made-regarding residence is something which allows for higher peace. Since Dave states, 100% out of foreclosed residential property got a home loan.

Reducing your architectural expenditures is another cause someone plan to pay off their household early. The brand new FI people is very large toward taking expenses only you’ll. You simply need faster from inside the savings when you yourself have a lot fewer expenditures.

I-go backwards and forwards and you can demonstrably do not have the finest answer. Mathematically it’s probably suboptimal however the liberty and you will independency that not that have a home loan proves shouldn’t be discounted. I would never ever give someone that they generated a mistake because of the investing it well. It may be a mathematical error however, that doesn’t mean it’s a life mistake.

The beauty of the newest FI travels is that you arrive at make you very own selection. Should you want to spend it, or if you want to invest that extra cashthe possibility was your very own.

Baby Action 7: Generate Wealth And give!

This will be literally the end out-of Dave Ramsey’s guide. Which songs therefore bland. Why read all of these financial hoops when you’re only browsing sit-down and you may matter your finances. Fantasy large! How would spent time in the event that currency just weren’t an effective factor? Might you volunteer on charities personal your own cardio? Would you travelling? Is it possible you move to a different country? Would you like to start a business?

I do believe the newest award of the many this is exactly versatility and you can autonomy. You get to build your best life today and you can ily date. Or perhaps its take a trip the country and asking on the suggestions one to you love to contemplate. Perhaps creating a book since you geo-arbitrage all over the world. So many possibilities and the just situation you are running out out-of is go out! This permits getting significant liberty.

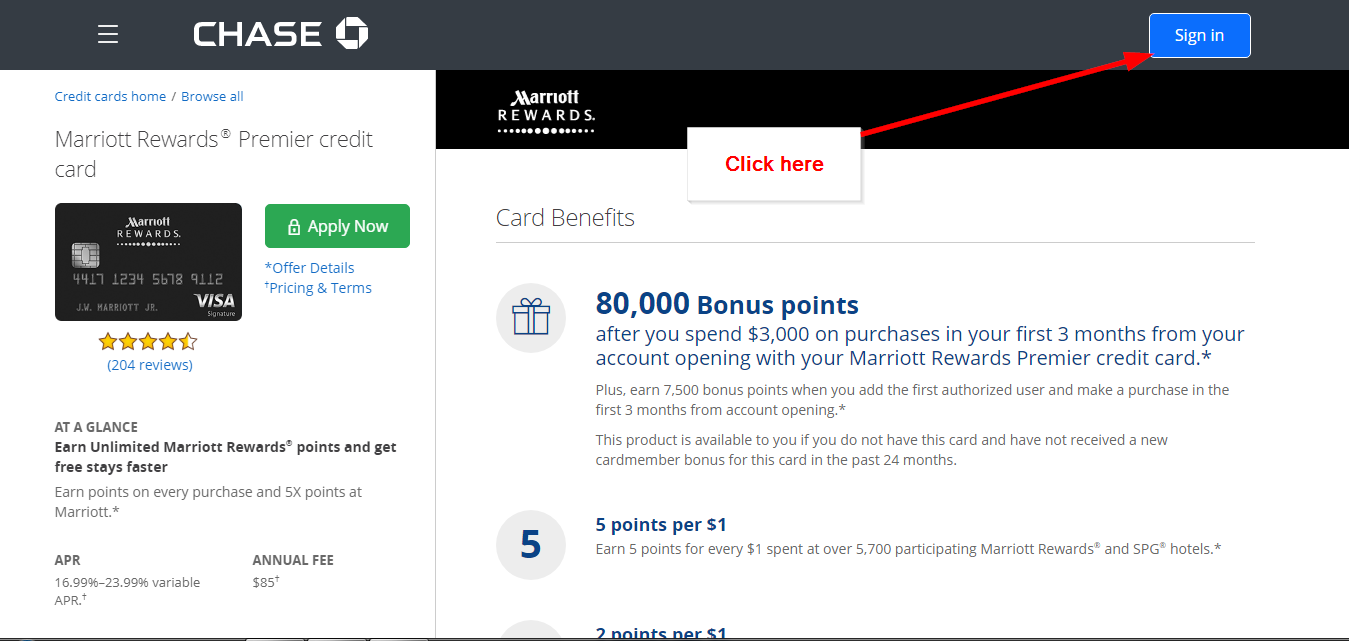

Discuss Travel Advantages, that requires taking advantage of mastercard sign up bonuses so you’re able to secure 5-10K inside free travelling each year. Feel a specialist in the putting these travel information to one another. Upcoming use the freedom away from FI to get the time for you make use of five-week holidays all over the world using my members of the family.

Child Step 3: Score 3 to 6 Days Off Expenditures For the Offers

For almost all People in america, rescuing fifteen% music high. Although not, regarding Flame people, 30%, 40%, and even 70% savings costs commonly strange because the we understand the importance of their savings rates. I real time much underneath our means, focusing on strengthening couch potato earnings channels thanks to opportunities, a home, and you can small business ventures.

- Put standards your child will work throughout college or university