To get property is an important life event. You will want to pay attention to the adopting the when applying for a beneficial mortgage:

Before you apply for home financing of a lender, you will understand very carefully the fresh terms and conditions, including tenor, payment plan, month-to-month payment amount, interest, types of focus formula, or any other related fees. You might thought asking the financial institution to show how month-to-month cost matter or other charge is actually computed with reference to a mock amount borrowed.

When selecting a home loan bundle, you will want to cautiously assess your cost. Also the down-payment and you will monthly cost, you should be the cause of other expenses, including financial management costs, judge charges, insurance costs, valuation declaration costs, etcetera.

Financial institutions ount predicated on a great amount of things, including the borrower’s payment ability, additionally the last acknowledged home loan number ount requested by the debtor. Before you spend a deposit towards assets, you will want to need a traditional means during the estimating the level of mortgage you could potentially obtain out of a financial so as to avoid with not enough funding to-do the acquisition.

Particular low-lender organizations (such as for example possessions developers and you can finance companies) may offer mortgage arrangements with a high loan-to-value (LTV) ratios and other promotion schemes in order to first-give assets consumers. While the financial venture schemes towards the very first several months ount of a few of these plans can get increase somewhat following the initial several years of installment. Audience is account for any transform (e.grams. improvement in financial interest rate) which can exist from the entire mortgage months and you will carefully assess the repayment feature to make shrewd and you can prudent conclusion.

When choosing a mortgage tenor, you must know debt updates and you will payment feature. Generally speaking, the new prolonged new tenor is actually, the low the newest monthly cost count nevertheless the high the entire attract costs. On the contrary, the quicker the newest tenor was, the greater the fresh new monthly payment number but the lower the full notice debts.

Home loan interest levels are typically calculated with reference to Hong kong Interbank Given Price (HIBOR) or Best loans in Branford Center price (P), each of being drifting rates of interest. HIBOR varies a great deal more, and you may home loan interest calculated with reference to HIBOR is often subject to a cover. Borrowers should read the energetic home loan rates while shopping around for the best really worth package.

Perfect rate is fairly stable, but the Perfect price given by for every financial can be different

The latest HKMA has introduced certain cycles out of macro-prudential actions as to compliment the risk handling of banking institutions within the carrying out possessions mortgage credit providers and you can strengthen the resilience of your banking field facing any potential downturn from the possessions markets. This new procedures integrated:

- tightening the most financing-to-really worth (LTV) proportion having property mortgage loans, that could angle high risks to help you financial institutions, including:

- mortgages to have applicants having one or more pre-existing mortgage loans

- mortgages having applicants whoever income is mainly produced from outside regarding Hong-kong

- mortgages having people centered on the net worth getting borrowing

- mortgage loans having non-self-use residential properties

- mortgages to own industrial and you can industrial qualities

- requiring financial institutions to make use of significantly more prudent requirements to assess the newest installment feature regarding financial applicants;

- limiting the most financing tenor for everyone this new property mortgage loans so you’re able to 30 years and you will car park mortgages so you’re able to fifteen years;

- demanding financial institutions having fun with Interior Feedback-Situated Approach to calculate money costs for borrowing from the bank chance to utilize exposure lbs floor because of their residential mortgage loans.

Please reference the fresh new attached desk concerning your information on the new LTV proportion limit and you can debt servicing ratio restrict for property financial financing.

In the figuring the debt repair proportion out-of a mortgage applicant, a bank needs under consideration the mortgage instalment also once the most other financial obligation money of your own applicant

The loan Insurance rates Programme (MIP) was launched by the Hong kong Mortgage Enterprise Minimal (HKMC). HKMC Insurance coverage Minimal, a completely-had subsidiary of your own HKMC, brings financial insurance coverage so you’re able to banking companies and you will enables them to bring mortgage financing having highest LTV proportion instead of running into most borrowing chance. The brand new downpayment burden of your own homeowners normally hence getting shorter.

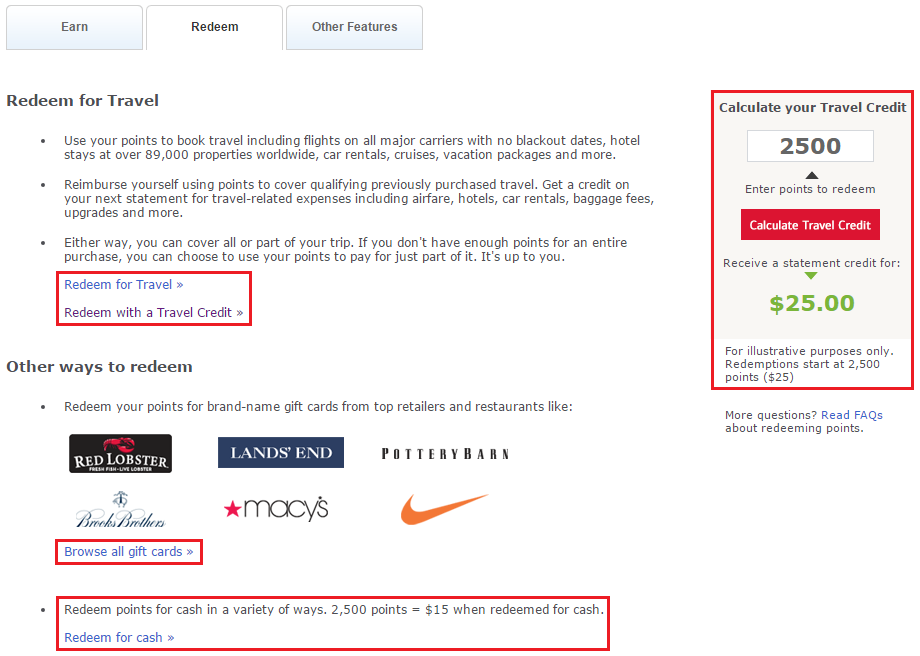

The loan Repayment Calculator aims to assess, in line with the rates your enter in to your Calculator, the brand new monthly mortgage payment count and its particular ratio so you’re able to monthly income (we.elizabeth. your debt repair ratio), and exactly how a change in the loan interest rate perform change the cost number. Excite just remember that , the newest formula results are quotes to possess reference simply.

Note 1: Banking companies commonly envision many different things whenever evaluating home financing loan application. The mortgage loan amount approved by banking companies ount asked because of the candidates.

Notice dos: Currently, another formulae are generally used for calculating home loan rates of interest. He or she is to have resource only. Excite consider the loan interest rate otherwise formula formula lay out in the newest regards to the mortgage.

Disclaimer: The results made by the borrowed funds Fees Calculator (Calculator) was having site only, no dependence would be place because of the any person to the for example outcomes for one motives. The fresh Calculator just takes into account the newest rates due to the fact inputted, and never any situations, such as the economic updates and fees function of the person or the regards to a home loan (eg courtroom costs, solution fees, rebates, etc.), that may change the overall performance if they’re considered about loan acceptance procedure. A lender do make up the related items (not just mortgage repayment) whenever determining an interest rate application. The results created by brand new Calculator dont by any means represent or reflect the level of mortgage loans that the bank will approve.