Missouri Attorneys General Andrew Bailey praised Schelp’s choice, saying when you look at the an effective Thursday overview of X that it’s an excellent huge earn to have transparency, brand new rule off rules, as well as all of the American which need not feet the balance for an individual else’s Ivy Category financial obligation.

Meanwhile, a representative on Institution of Studies told you the fresh new department is actually really troubled by this governing into our advised debt settlement laws and regulations, with not yet also been closed, for every a payday loans West Virginia statement.

This lawsuit is actually lead of the Republican decided authorities who made clear might visit nothing to stop countless their unique constituents of providing breathing room to their student loans, brand new spokesperson said.

This new service usually consistently intensely guard these proposals during the courtroom and you will cannot stop attacking to fix the fresh new broken student loan program and supply service and you may save to help you borrowers all over the country, they extra.

Using this type of case, the fresh new Missouri Attorney General will continue to place naked political notice and business avarice before student loan individuals into the Missouri and you will all over the country, Persis Yu, deputy administrator movie director and you can controlling the advice to the advocacy class, told you inside a good Thursday declaration.

This will be a shameful attack toward tens out-of countless beginner loan borrowers and you may our judicial system overall, Yu told you. We are going to perhaps not avoid assaulting to reveal such abuses and make certain individuals get the rescue they need.

By: Shauneen Miranda –

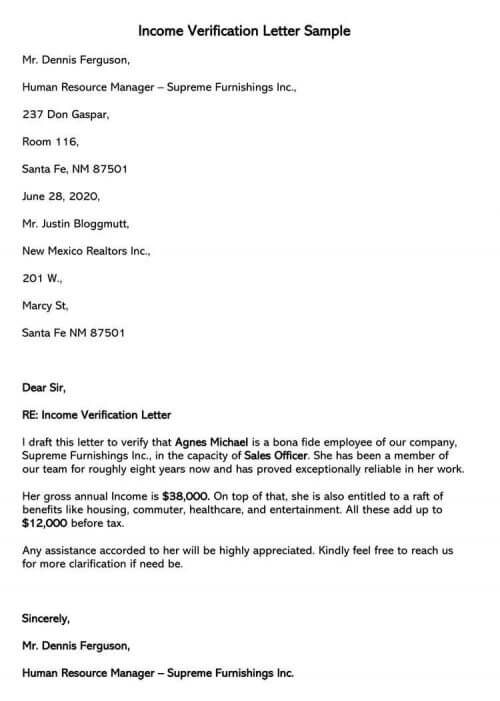

An effective Thursday governing from inside the federal courtroom when you look at the Missouri next prevents this new administration’s jobs to promote their work with college loans prior to the latest November election. (Photo by the Getty Photos)

The new governing further stops new administration’s operate to promote the performs for the student loans and you can appear in the middle of chronic Republican pressures in order to Chairman Joe Biden’s college student debt settlement initiatives.

The new administration, and therefore unveiled brand new plans within the April, told you this type of jobs would offer beginner credit card debt relief so you’re able to over 31 million borrowers. The new proposals was basically never closed.

The match, registered into the a beneficial Georgia government judge, came only weeks once a different sort of beginner credit card debt relief effort – the Rescuing to the a very important Degree, otherwise Conserve, package – continued to be put-on stop adopting the U.

Schelp provided new states’ consult towards the Thursday, composing that administration is actually banned from bulk canceling student education loans, flexible any dominant otherwise desire, perhaps not battery charging borrowers accumulated desire, or further implementing another strategies in (debt settlement plans) otherwise training government builders for taking such as tips

Following September filing of the fit, You.S. Region Judge J. Randal Hallway out-of Georgia paused the master plan thanks to a short-term restraining order with the Sept. 5 and you may expanded one to purchase into the Sept. 19 given that circumstances might be assessed.

But on Wednesday, Hall assist that buy end, overlooked Georgia on the suit and went the outcome so you’re able to a good Missouri government judge.

Since the fit transferred to Missouri plus the restraining buy are perhaps not prolonged, the rest six claims in the case easily sought for a primary injunction.

Missouri Lawyer General Andrew Bailey applauded Schelp’s choice, saying in the an effective Thursday article on X that it’s a good grand victory to have transparency, the new rule of rules, as well as the Western who need not legs the bill for someone else’s Ivy League debt.

Meanwhile, a representative on the Service of Training said the newest agencies is really distressed from this ruling to your the advised debt settlement regulations, having not even also already been closed, for each a statement.

So it lawsuit are brought of the Republican select authorities which made clear they’re going to take a look at absolutely nothing to prevent many their own constituents regarding taking breathing room to their college loans, the representative told you.