Now that you’ve got a resources in mind and get analyzed their county’s mortgage limitations, you are willing to move on to more hands-on steps in the newest FHA home buying procedure. For 1, you could start in search of a lender.

Step four: Come across an FHA-accepted lender.

One which just apply for a keen FHA loan, you have got to select a home loan company that participates on the program. The good news is, this really is easier than you think to complete.

Most of the biggest financial businesses give FHA money. An identical holds true for a lot of local and you can regional banking institutions and you will lenders. Particular businesses even focus on authorities-backed home loan software FHA.

- You can use the latest search unit on Company from Construction and you will Metropolitan Innovation web site.

- Can help you a bing identify your city or state.

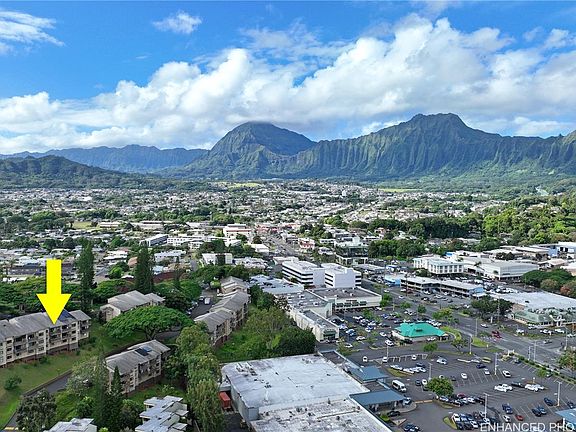

- Make use of an internet industries including the Zillow mortgage areas to examine FHA loan providers.

- You can also put a call aside during your social media networks, asking for information (ideal).

Mortgage pre-recognition is usually the second step about FHA property techniques. It functions such a type of evaluation techniques. The loan bank often review the money you owe – instance your earnings, assets and repeated expense – to choose while you are eligible to an enthusiastic FHA mortgage.

They will certainly together with regulate how far you can make use of use, according to the loan restrictions stated prior to as well as your personal certification while the a debtor.

Pre-acceptance is an important step up the newest FHA real estate process because it allows you to look for a property one drops in this a particular spending budget. Or even rating pre-accepted, you may not even understand how much you can actually manage to invest in. You could wind up throwing away valuable time deciding on property that are outside your own financial support variety.

Getting mortgage pre-recognition ahead of family browse will make you a better house buyer and increase your opportunity of achievements.

Step 6: Start interested in a property.

You may have a budget planned. You’ve examined the loan constraints toward condition the place you need purchasing. You receive a mortgage lender and you may obtained pre-accepted getting a specific amount.

Today you will be prepared to hit the crushed powering. You could go out and look for property that drops inside your price range, into the confidence that you could in fact manage to buy it. (There can be a reason the newest strategies are put up like that.)

That it an element of the FHA property processes really works the same because it would if perhaps you were using a frequent otherwise antique mortgage loan.

We recommend searching for an experienced real estate professional in order to from household search techniques, but that’s up to you. There is absolutely no legislation that really needs you to definitely fool around with a realtor when purchasing a house. But an agent can help you prevent high priced problems and work out a sensible bring centered on market requirements.

As well as, remember that the home you should purchase need feel assessed of the a keen FHA-acknowledged household appraiser. We are going to cam much more about you to for the action #8 lower than.

The offer and you will settling techniques is typically the next step during the this new FHA property process. This step happens after you have located property that meets your needs and you can drops inside your finances.

Contemplate, it doesn’t add up and work out an offer to your a house you to exceeds the mortgage pre-acceptance number (unless you’re probably compensate the real difference from the individual wallet).

The offer processes having an no credit check payday loans in Standing Rock Alabama FHA financing functions same as they carry out with any other kind away from financial. But it’s crucial that you know that particular manufacturers could be reluctant to accept a deal from a purchaser using the FHA system.