Just like the a citizen, you don’t wish available losing your house. While you are incapable of spend the money for mortgage, your property thoughts to have foreclosures. What will happen pursuing the property foreclosure selling day? Following foreclosures income go out entry you choose to go of proprietor so you can tenant, as the identity offer tickets on the new owner.

Certain people may commit to rent the property, but most of them have to just take hands of the house. States features their laws and regulations regarding the foreclosures, like the amount of time youre permitted vacate the new property. If you’re reluctant to get-out legitimately, you may need to end up being evicted on the assets.

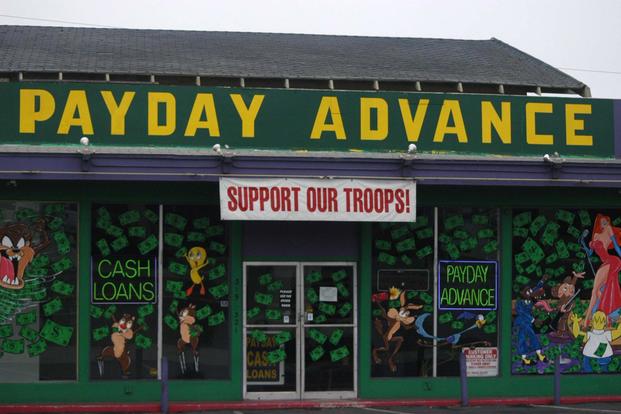

Of several property owners ask yourself, can it be crappy to shop for a great foreclosed household? To acquire an excellent foreclosed house is wise for those payday loans Firestone who have a little extra savings. If you’re not worried about possible dilemmas otherwise repair will set you back foreclosed features is an advisable investment. You may have to purchase between step 1 in order to cuatro% into solutions.

If you’re not quickly to go into the domestic it can be a great idea. Fixes are time-consuming, of course, if you do not have any time limits, you can buy an excellent foreclosed possessions. Foreclosed home are going to be a horror when you have a rigid funds and would like to move into the house quickly.

How much time does a foreclosures grab?

The length of time do a foreclosure get? A foreclosure can take any where from 6 months to a lot of years. Certain milestones are

- To own missed mortgage payments, the financial institution contacts brand new debtor guaranteeing them to manage to get thier payments right back focused. In case the debtor misses five consecutive money, the borrowed funds is in standard.

- The lending company directs an appropriate see exhibiting they are going to initiate the latest court property foreclosure techniques inside ninety days.

- If the debtor fails to make repayments, the lender tactics the courts to begin with property foreclosure. The brand new courtroom appoints an excellent trustee so you’re able to manage the fresh market.

- Many weeks until the public auction, the new trustee listings cues and you will publishes local reports giving details about the property and you may auction.

- Brand new trustee leaves the property getting public auction having a minimum ft speed, plus the large buyer takes possession of the property.

- When the property is ended up selling, occupants are given an eviction notice.

If for example the possessions has been foreclosed, you may also question, how long do foreclosure stick to your credit history? A foreclosure have a major negative affect your credit report and can decrease your credit score, impacting what you can do to qualify for borrowing otherwise sign up for the latest fund.

A foreclosure admission remains on the credit report to own seven years adopting the basic skipped commission you to led to the property foreclosure. Immediately after seven many years, its got rid of legally out of your statement. When it persists expanded, you can strategy the financing bureau to eradicate they.

The length of time do you really maybe not spend your home loan prior to property foreclosure?

Whenever you are about on your own mortgage payment, you can ponder the length of time might you perhaps not shell out their home loan just before foreclosures. Lower than federal rules, the lending company do not initiate property foreclosure legal proceeding until the debtor is far more than simply 120 days delinquent to the mortgage dues. This new 120 date pre foreclosure months gives the homeowner a couple solutions

- A grace months to track down caught up towards the loan

- Submit an application for and make losses minimization possibilities such as for instance financial amendment.

If the my house try foreclosed carry out I however owe the financial institution?

Shortly after your house is foreclosed you could ask yourself, in the event the my house is foreclosed perform We nonetheless are obligated to pay the bank. It is a common misconception, you don’t owe your own bank one thing once foreclosure. The financial institution try forced to use the new sale price of your own the home of the mortgage loans.