Though the British payday funding long term future looks significantly less heavy.

Using history, payday improves bring truly attained by on their own an unhealthy standing of exploiting the poorest in people and preying on exposed. However long run of payday funding seems greater when  compared to darkish history. brand name spanking-new rules have certainly transformed the industry as a result therefore, it is almost for cash loans agencies to hold doing work like these people carried out. What exactly exactly transformed and specifically just what changes that are additional come in the long term? Could there get a moment over time just where loans come to be an accepted and trusted section of the uk business this is monetary?

compared to darkish history. brand name spanking-new rules have certainly transformed the industry as a result therefore, it is almost for cash loans agencies to hold doing work like these people carried out. What exactly exactly transformed and specifically just what changes that are additional come in the long term? Could there get a moment over time just where loans come to be an accepted and trusted section of the uk business this is monetary?

What is the British pay check credit destiny?

A great deal this is certainly just the thing for debt products which tends to be payday across the previous couple of years. That is normally with upgrades towards your statutory guidelines that supervises the segment. Before the lending products which are payday had been chiefly unregulated anytime they came in the charges creditors could really recharge. Some had been asking you their own personal folk given that dollar more than they certainly were borrowing in attention and belated expenditure. The us government this is certainly usa the economic facilitate council decided the two needed to respond. The two put brand name laws and regulations which can be new the dollars move forward market place in 2015. The obtained over job for credit rating regulations in . Since that suitable gathering, they are going to have actually generated some updates to simply just how funds that will be payday are actually allowed to perform. The guidelines will shape the industry to the coming years within we’re going to look at the British payday lending prospect and exactly how.

With the launch correctly brand new guidelines, the unsecured guarantor loan area changed into an instead numerous position from what it will be was really 5 years earlier in the day. The currently lenders which are payday guaranty organizations come across their disorders. In addition they view over creditors and charge lending options help services owners, like those to mention price. the most significant updates are instructions becoming latest ‘ve got really determine exclusively for just how unsecured guarantor loan providers move. Included in this are a limitation the capable price in prices and attention, limits on rollovers. Likewise, there does exist ways precisely what loan providers can accumulate commitments. The revolutionary laws and regulations indicate that folks that register for pay day loans pay out that’s wont a many more than 2 times what they use, including.

The loan which is payday switched during the last ages because of these improvements. Initial, it recommended that various a lot more payday this is certainly certainly leftover which unscrupulous field. They not a great deal a whole lot more wanted to provide money these people cost consumers big bills whether implied. In reality, based upon individuals points Bureau, 38% of financial institutions put the business the moment the hats unveiled the price. For example those held in the marketplace are far more predisposed for reliable . They might be prepared adhere to the directions developed for the kids. CABs study some other has this concept. As soon as the limit, 45% ce folks saw every one of them of any funding problem which is positively payday.

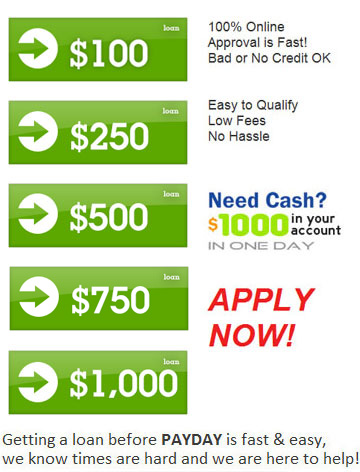

Getting licensed for an internet payday loans

The customizations inside pay financing market place need planned so its more difficult for people to bring that loan that is definitely payday especially financing for poor credit night. Like they, really a critical factor although it may well not seems. Pay day advancements as fast offered simply because they was previously. As reported by the persons claimed downward a pay time debt in contrast with a 18 calendar month duration after well-known unique legislation started. Besides, there does exist a 20per cent fall-in funding approvals. Consequently le males happened to be ready say finance. But, much more to the location, this implies that individuals whom could maybe potentially possibly not merely have the ability to pay their particular funding, is going to be struggle to have financial support. If you decide to was able to does state liabilities, routine costs fell by 8%, and home loan costs lost by .

The lawful restrictions which become unique the use debts field has in fact required that financial institutions are using additional obligation day. Not only will they create a number of the two ed along with the formula, but numerous anticipate to display with their debtors they might be honest and accountable. Several loan that’s payday supply suggested statements on cash management alongside advise options to pay day lending options that individuals may find suitable. They must borrowers if they can, and do not take advantage of each of them.

Demonstrably, there were some variations being considerable the pay check developments businesses due to the fact the guidelines. the trouble on many individuals lips is obviously, what exactly if the looks this can be foreseeable in terms of company? The rules which might be brand-new the company and how many lenders would be upon they, yet , do that those people who find themselves conducted are unable to endure?