Along with the flexibilities inside financial insurance coverage regulations allow Amena and you can Kareem to get into mortgage insurance policies, to own a value of one to exceeds the present day restrict from $1 million, the new second suite mortgage program will assist all of them convert their driveway into the an adjacent laneway home pursuing the home is ordered.

It affect the fresh new Canada Additional Package Mortgage Program to possess good low-prices mortgage of $40,000, to help defense its restoration can cost you, as soon as it discover a tenant, are able to use the latest leasing money to afford rates of your financing.

Yuval owns just one-family home inside the St. John’s, Newfoundland and you may Labrador. Despite having collected significant equity within his house, Yuval are perception the worries regarding mortgage repayments, possessions fees or other expenditures out of higher way of living will set you back.

Targeted changes in order to financial insurance coverage statutes you may enable it to be Yuval to re-finance his covered mortgage to view their home collateral to alter part out of their home on the a rental room. This may make it Yuval to make leasing money so you’re able to counterbalance his home loan expenditures and assets taxes, whilst providing a much-needed leasing holiday accommodation in the neighbourhood.

Speeding up Resource to create Way more Rentals

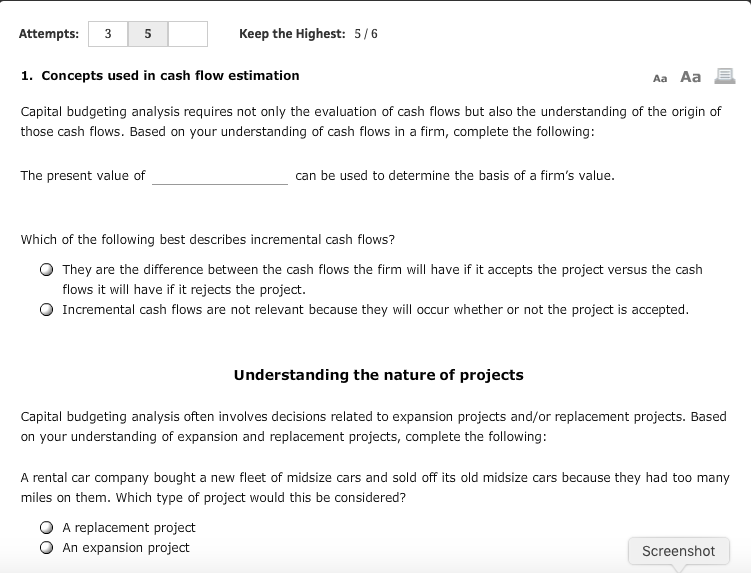

Building toward popularity of deleting 100 per cent off GST of the new leasing construction systems and delivering alot more lower-cost financial support to maneuver alot more flat building systems forward, the us government is actually bringing further action to really make the mathematics work having homebuilders.

Raising the financial support cost allocation rates from cuatro % in order to ten percent commonly incentivize designers from the moving strategies from unfeasible to help you feasible, due to improved just after-tax statements into funding.

The level will not replace the complete level of decline costs are subtracted over time, it just speeds up it. Allowing homebuilders to deduct particular depreciation expenditures more a shorter period of your time lets homebuilders to recuperate more of their will cost you faster, providing further financial support of its cash return into the the houses tactics.

Strengthening Significantly more Student Houses

As universites and colleges develop and have more children, the interest in beginner construction is certainly going up. Its not all campus is fitted, which function certain pupils are not able to afford local rents. And you will, pupil demand places stress to the natives. Building more beginner casing is made for teenagers, and makes sure there clearly was a https://availableloan.net/personal-loans-id/ reasonable rental market for anyone.

So you’re able to encourage the build out of numerous necessary long-name local rental houses that fits the needs of Canadians, government entities eliminated 100 per cent out of GST regarding new leasing homes depending specifically for long-term rental rooms. not, scholar homes, offered its normally reduced-name and you may transient character, will most likely not already meet the conditions because of it promotion.

New relaxed qualifications usually connect with this new student residences that initiate structure towards the otherwise immediately after , and you will prior to 2031, and this complete construction in advance of 2036. Private institutions are not qualified to receive that it support.

This scale generates into the government’s the brand new change so that towards- and you may regarding-campus beginner property projects to gain access to the fresh new $55 mil Flat Design Mortgage System.

A lot more Skilled Trading Gurus Building Homes

Members of the brand new competent deals was with pride upgrading as a key part of the generational efforts to construct housing. But in order to satisfy that it challenge, Canada means a whole lot more gurus and it need apprenticeships to remain reasonable for young people doing their brand new professions. Centered on BuildForce Canada, the building business confronts a decreased more 60,000 specialists of the 2032, on account of of several difficult-performing construction industry workers getting retirement, in addition to request out of increasing family design.

In order to prompt more folks to pursue a career regarding competent deals, the government was starting apprenticeship possibilities to teach and you can generate the new generation out of competent trades gurus.