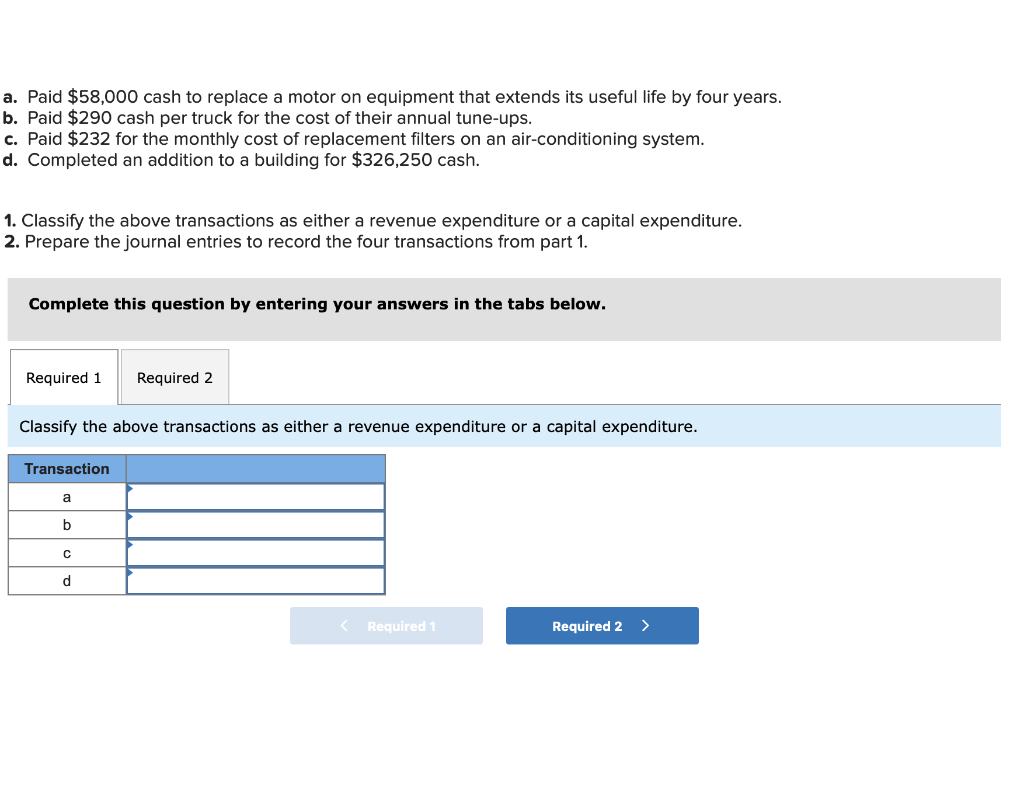

Area interesting

Home guarantee financing and you may house guarantee credit lines (HELOCs) will let you tap into your home’s worthy of to pursue almost every other financial goals, off using college tuition so you’re able to remodeling the kitchen.

As the a resident, you might also understand how to use domestic guarantee you to you collected of your home, or the portion of the house that you own downright, to help you loans the life’s larger expenses, such as for example degree will set you back, scientific debt otherwise household home improvements. You may not can actually borrow secured on your house collateral, in the event, so our company is here in order to shape one to aside. Why don’t we evaluate house guarantee money and you will house guarantee personal lines of credit, the way they performs, and just how they are utilised to pay for stuff you prefer.

What is actually domestic equity?

Home guarantee, simply speaking, is the part of your home which you have currently purchased hence own. If your residence is worth $250,one hundred thousand and you have home financing which have $100,one hundred thousand kept to pay, your home security is roughly $150,100. Once the a homeowner, when you find yourself asking yourself, How does a house guarantee loan works, you can test it cash in the lending company which you’ll borrow against to invest in almost every other objectives.

Ideas on how to borrow secured on their security

There are two main a way to borrow secured on your home guarantee. Having a home collateral loan, you’re given the money in general lump sum and also make fixed monthly installments along the lifetime of the mortgage to repay exactly what payday loans Collinsville you owe.

Property equity personal line of credit (HELOC) performs more like credit cards. You might be given a personal line of credit with a threshold that you can be mark regarding, as needed, having a specific amount of age, and you can pay it back and you can draw of it again. This era is called their mark months. During this time, you simply need to pay interest on what you have lent. Immediately after its more than, you might no more borrow on your home along with first off repaying both dominant as well as the appeal.

4 Basics of utilizing Family Equity

Domestic guarantee and you may HELOC financing can provide you with much-called for dollars, but exactly how does a house guarantee loan work? Discover all of our guide less than into the cuatro requirements of employing your own residence’s security.

How to pick ranging from a home guarantee loan or HELOC

Going for ranging from a house guarantee loan and you may a property collateral line off credit boils down to the method that you must supply the money and how you’d like your payments is organized. Having property equity loan, your finances is paid in one single large lump sum payment. This makes it top suited for one-big date will set you back such as paying high expenses or merging financial obligation. An excellent HELOC, at the same time, will likely be borrowed out of as often as required, making it a much better selection for lingering will set you back including using tuition.

Having house security mortgage prices, your instalments is fixed, causing them to a no brainer for those who need certainly to keep to a rigorous budget. HELOCs, meanwhile, support interest-simply repayments inside the draw several months and you may a fees of each other the primary and notice after. While this provides your repayments reasonable initially, the new costs is certainly going right up after you go into the cost several months.

Simple tips to Calculate Your loan Payments

To help you estimate payment per month on property equity mortgage, split the total amount you borrowed from while the rate of interest of the quantity of repayments. Which have repaired repayments, you can pay the exact same per month. To have a house guarantee line of credit, using your initially mark several months, it is possible to multiply your interest by the number which you lent. Up coming, using your cost several months, it will become fascinating: you can reason for exactly what you’ve lent and your interest and you can divide that towards the fixed monthly obligations.

The truth is that undertaking the brand new mathematics into the a house guarantee loan or a good HELOC will get challenging. Your best bet on learning exacltly what the monthly obligations commonly feel is to apply good HELOC-specific calculator, otherwise have your bank build up the numbers to you prior to your to remain the fresh new dotted line.

Strategies for Security to lessen The Attract Payments

A different way to influence your residence security is by using it to help you consolidate the a good bills. This will and make it easier to ount you only pay in total, due to the fact shorter focus tend to accrue over time.

To do this, begin by adding up your own overall month-to-month financial obligation money. Take-out a home equity loan in this number. The home collateral financing or house equity line of credit rates could be lower than what you’re expenses towards the playing cards and you will almost every other personal debt. Use the lump sum payment out of your home security loan so you’re able to repay any expense. After men and women are paid back, all you have to care about is actually one payment for your home equity financing.

As family equity mortgage is actually protected by your house, it will have probably a lower rate of interest than many other unsecured forms of personal debt, specifically playing cards and private fund. Towards the drawback, the financial institution takes arms of your home if you prevent to make money.

How to Restrict your Usage of Equity

Credit facing your home is a critical starting. Anyway, when you take aside property security financing or HELOC, in addition allow the lender the ability to foreclose on your domestic for many who get behind on the obligation to settle.

With that in mind, you should limit the use of the collateral on the the place to find items that try it really is needed. While it could be appealing to make use of the cash for cheap extremely important expenditures, like that fascinating warm vacation or a large buy, you will be better prepared by saving up-and prepared until there is the cash in hand. Since equity of your property was a very important product to enjoys available, also, it is nothing to be taken softly.

The final word

When utilized wisely, a house collateral mortgage otherwise credit line would be an interesting solution to leverage the importance you have got of your house to fulfill other monetary wants. Even in the event you should be mindful while using the they easily – as you do, anyway, need to pay they right back with desire – that loan or credit line could save you money in the long run by permitting to possess debt consolidating otherwise make it easier to various other suggests.

Its an infusion of cash that you could maybe not or even end up being able to access, your home is on the line for many who standard, very capitalizing on it ought to be weighed heavily to your benefits and drawbacks together with your state.